“Financial institutions that continue investing in companies

building nuclear weapons face regulatory risks

as more countries join the treaty.”

Jessica Corbett / Common Dreams

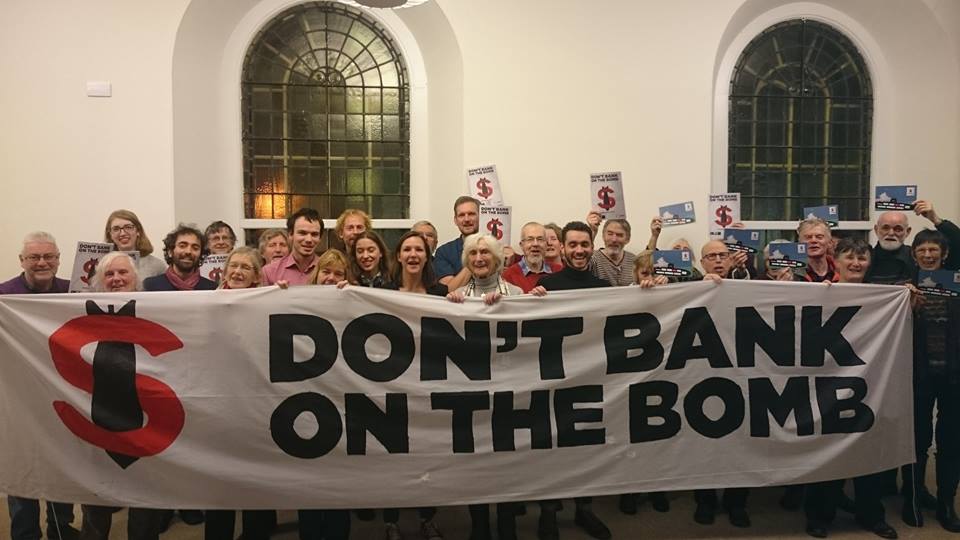

(November 11, 2021) — The latest Don’t Bank on the Bomb report, released Thursday, sheds light on the early impacts of a global treaty banning nuclear weapons worldwide while also exposing the companies and financial institutions responsible for continuing to build up governments’ arsenals.

The new report from the International Campaign to Abolish Nuclear Weapons (ICAN) and PAX comes as the world nears the one-year mark of the Treaty on the Prohibition of Nuclear Weapons (TPNW) entering into force after opening for signature in September 2017.

“This report looks at those with vested interests to keep a nuclear arms race going,” principal author Susi Snyder of PAX explained in its foreword. “The companies that want to get contracts to build weapons of mass destruction, and the private sector financiers and investors that want to generate a profit without apparent concern for the devastating potential consequences of any use of the products they support.”

“It is only by knowing those who seek to maintain the status quo that we can engage and shift their behavior,” Snyder continued. “These profiteers can and do change their behaviors. A combination of the emerging norm against nuclear weapons, the growing strength and membership of the TPNW, and the increasing stigma against weapons designed for mass destruction are leading companies away from harmful contracts and investors to consider alternatives.”

Entitled Perilous Profiteering: The Companies Building Nuclear Arsenals and Their Financial Backers, the report says that $685 billion was made available to the 25 nuclear weapons-producing companies between January 2019 and July 2021 — a $63 billion drop from the previous Don’t Bank on the Bomb report, which covered the two preceding years.

“There is a downtrend in the total number of investors, as well as in share and bondholding,” the report highlights. “Overall, there are 75 new financial institutions with investment in nuclear weapon producers, while 127 divested in the previous year, bringing the total number of investors down from 390 to 338.”

The report points out that several of the financial institutions that divested from the sector are from states that joined the treaty—such as Allied Irish Banks and the Bank of Ireland as well as Investec in South Africa—and “while other institutions made new investments, these are predominantly from countries not yet a member of the TPNW.”

None of the nine known nuclear-armed nations—China, France, India, Israel, North Korea, Pakistan, Russia, the United Kingdom, and the United States—support the treaty. Many of the companies that produce such weapons are based in those countries.

Still, as Perilous Profiteering details, the nuclear industry is changing:

The re-nationalization of the UK’s Atomic Weapons Establishment removing Serco from the list of publicly traded companies involved in the production and maintenance of nuclear arsenals is one example. The sale of all government-related contracts of another long-term nuclear weapon associated company (AECOM) so that it is no longer involved in any aspect of nuclear weapon development or stockpiling is another. These changes removed these companies from their association with the production of nuclear weapons, as well as several investor blacklists.

“The industry itself is getting smaller, with companies acquiring or merging together,” according to the report. “Raytheon and United Technologies is one example, Northrop Grumman’s acquisition of Orbital ATK is another.”

“Northrop Grumman is the biggest single nuclear weapons profiteer, with at least $24 billion in contracts, not including consortium and joint venture revenues,” the report notes. “Raytheon Technologies and Lockheed Martin also hold multi-billion-dollar contracts to produce new nuclear weapon systems.”

“The entry into force of the Treaty on the Prohibition of Nuclear Weapons is an historic shift in the way the world deals with nuclear weapons,” says the report. “Financial institutions that continue investing in companies building nuclear weapons face regulatory risks as more countries join the treaty. They also face an increased reputational risk as clients learn of their support for weapons of mass destruction and terminate their relationships.”

Published as COP26 begins to wrap up in Glasgow, Scotland, Perilous Profiteering suggests the global community should be pouring money into battling the climate emergency rather than making more destructive weapons systems.

“With trillions of dollars of wealth moving steadily into the sustainability market, investments cannot only do well, they must also do good,” the report says. “Financial institutions are racing to demonstrate their efforts to reduce their impact on the climate.”

“Wealth generation isn’t enough, customers and shareholders are looking for ways to reduce the harm to our shared environment and ecosystem,” the report concludes. “Stopping the production, development, manufacture, and financing of nuclear weapons is a way to protect people and the planet from this existential threat.”

Our work is licensed under Creative Commons (CC BY-NC-ND 3.0). Feel free to republish and share widely.