The Inflation Reduction Act Is NOT a Climate Bill

Indigenous Environmental Network

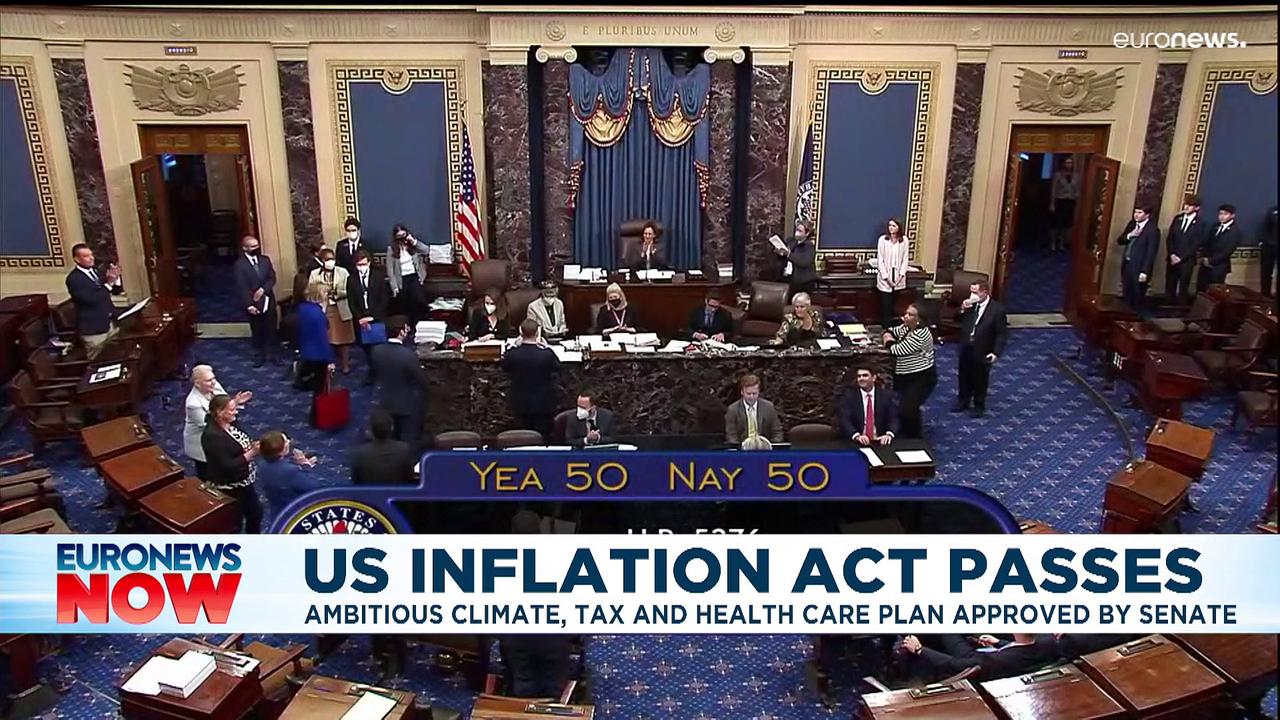

(August 4, 2022) — The Inflation Reduction Act (IRA) is a distraction from the need to declare a Climate Emergency, while allowing polluting industries to continue business as usual.

The IRA is a Trojan Horse

By co-opting the language and demands of environmental justice and frontline communities towards environmental and climate justice, the IRA is a wholesale package to distract the public from the inaction of the federal government and ensure our path to climate catastrophe. It does not adequately address the root cause of the climate crisis and ban extractive industries from exploiting the Earth.

Instead, it relies heavily on climate criminals to solve the interlinked climate and economic crisis. This will, however, perpetuate social injustice and intensify the planetary crisis.

This bill does not absolve the President

from the responsibility to declare

a Climate Emergency.

The Timing of the IRA is NOT a Coincidence!

Despite persistent pressure to call for the federal government to declare a Climate Emergency, the Biden Administration has continued to delay urgent actions to address the climate crisis. Instead, they are pushing for a bill that would not only ensure the continued reliance on fossil fuels, but also exacerbate social injustice and climate change.

The IRA Increases Leasing of Public Land

For Fossil Fuel Extraction and Production

Instead of phasing out the fossil fuels industry, the IRA set up a quid-pro-quo framework where wind and solar development is tied to increased oil and gas leasing to build out fossil fuel infrastructure.

- Toted as “energy security,” for the next ten years, the IRA prohibits any offshore wind lease sales unless the DOI has held at least one offshore oil and gas lease sale within a year before the wind lease sale. The oil and gas lease sale must be at least 60,000,000 acres (p.644).

- This is of particular concern for BIPOC communities, especially Alaska Native, communities in the Gulf South, coastal communities and communities near federal-owned lands.

The IRA Makes Misleading Promises

The package promises to provide over $60 billion in funding for “environmental justice priorities.” However, the bill offers no criteria for what qualifies as an EJ provision. As a result, there is no clear way to verify the promised amount of investment. Moreover, a provision that has no positive impact can claim to have “EJ priorities.”

Furthermore, the language and scope of some the “EJ provisions” are framed in a way that risks perpetuating injustice to disadvantaged communities, particularly to Tribal Nations and Indigenous Peoples.

- Eligibility guidelines for EJ provisions allow corporations and large NGOs, detached from on-the-ground realities, to apply for the grants.

- Because receivers of the grants and funds are chosen on a “competitive basis”, NGOs backed by large corporations and polluters can apply with the resources to gain an advantage.

- The provisions do not establish a minimum or maximum number of grant recipients. This means that NGOs and for-profit companies with a competitive edge can acquire large chunks, or the entirety, of the available funds.

- Projects can be taken over by for-profit interests of investors even though they go through non-profit organizations.

- Application of “zero-emission” projects with the involvement of the private sector risks the proliferation of false solutions like CCS and goes in tandem with the push for ESG reporting in Sec. 60111: Greenhouse Gas Corporate Reporting. This gives corporations, not EJ communities, credit for implementing green energyprojects to make “sustainability” claims.

The IRA Funds False Solutions

The great majority of the dressed up climate provisions are investments into false solutions like CCS, nuclear, hydrogen, biofuels, and carbon trading. This bill continues where the Infrastructure, Investment and Jobs Act left off by propping up the same harmful industries BIPOC and frontline communities have been fighting for decades.

The primary beneficiary of these provisions will be the fossil fuel industry, since they are major players within the development of these unproven technologies. Public money will be increasingly funneled to polluting companies through the expansion of the tax breaks and tax credits.

The IRA Financializes Carbon

The IRA is setting up legislative infrastructure to support a carbon market for carbon offsets. Carbon offsets are bought by fossil fuel and other private industries to falsely claim they are “net-zero” or “carbon neutral”. The first step to build a carbon market is to measure the carbon.

Not surprisingly, provisions on agriculture award investments to projects that quantify carbon and continue the work of setting up agriculture carbon offsets called “climate-smart agriculture.”

The provisions on forestry aim to increase funding for the “participation of underserved forest landowners in emerging private markets for climate mitigation or forest resilience…” (pg. 536). The “emerging private markets for climate mitigation” are to be used to prop up carbon markets that benefit the fossil fuels industry. This is not environmental justice nor climate mitigation (p.546)

For further analysis into the IRA and its impact on environmental and climate justice, visit: IENearth.org